$5,000+ SSA Checks Hit Bank Accounts: If you’ve been waiting for that much-anticipated June Social Security check to drop, it’s almost time. On Wednesday, June 11, 2025, some retirees will see Social Security payments topping $5,000 hit their bank accounts. But not everyone qualifies for this amount. In this guide, we break down exactly who’s eligible, why the payment may be so high, and what changes in 2025 could affect your benefits. Whether you’re a retiree, financial planner, or someone nearing retirement, this article offers practical advice and insights written in a clear, conversational tone—just like you’d explain it to a friend at the local diner.

$5,000+ SSA Checks Hit Bank Accounts

June 2025 is shaping up to be a rewarding month for many retirees—especially those who planned ahead. If your birthday falls between the 1st and 10th and you meet the criteria for the max benefit, that $5,000+ Social Security check could soon be in your account. For others, it’s a reminder of the importance of strategy when it comes to retirement income. Use tools, stay aware of legislative changes, and talk to a financial advisor if you need help mapping out your plan.

| Topic | Details |

|---|---|

| Payment Date | June 11, 2025 |

| Eligible Birthdays | Birthdays between 1st–10th of any month |

| Maximum Social Security Benefit (2025) | $5,108/month |

| Average Retirement Benefit (2025) | $1,976/month |

| Cost-of-Living Adjustment (COLA) 2025 | 2.5% |

| Supplemental Security Income (SSI) Max | $967/month (individual), $1,450 (couple) |

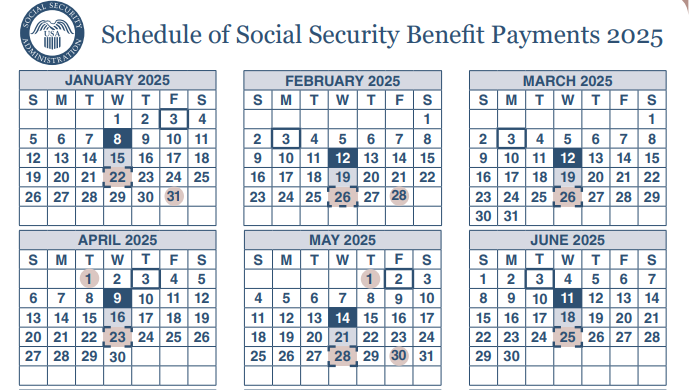

| Official SSA Resource | SSA.gov Payment Calendar |

Why June 11 Is a Big Payday for Some?

Not everyone gets paid on the same day. The Social Security Administration (SSA) staggers payments based on your birthday and when you started receiving benefits.

If your birthday falls between the 1st and 10th of any month, and you began receiving benefits after May 1997, you’ll receive your June 2025 Social Security payment on Wednesday, June 11.

For many recipients, this will be a standard monthly payment. But for high-earning retirees who delayed benefits until age 70, this check could be over $5,000.

Who Qualifies for the $5,000+ SSA Checks Hit Bank Accounts?

To get the max monthly benefit in 2025, which is $5,108, you’ve got to check off some very specific boxes:

1. Delayed Retirement Until Age 70

This is a biggie. If you waited until age 70 to claim Social Security, your monthly benefit could be up to 32% higher than if you claimed at full retirement age (FRA).

2. Earned the Max Taxable Income for 35 Years

You must have earned at or above the maximum taxable earnings limit ($168,600 in 2024) for at least 35 years. That’s what Social Security uses to calculate your Average Indexed Monthly Earnings (AIME).

3. No Early Claim Penalties

If you claimed benefits early (before your FRA, usually around age 67 for most), your benefit would be reduced permanently.

Pro Tip: Even if you didn’t hit every mark, delaying benefits as long as possible still boosts your check.

How Payments Are Scheduled Each Month?

The SSA follows this general payment schedule:

- 2nd Wednesday (June 11): Birthdays between 1st–10th

- 3rd Wednesday (June 18): Birthdays between 11th–20th

- 4th Wednesday (June 25): Birthdays between 21st–31st

If you started receiving benefits before May 1997, you get paid on the 3rd of the month, regardless of your birth date.

Supplemental Security Income (SSI) is typically paid on the 1st of each month, but if the 1st falls on a weekend or holiday—as it does in June 2025—payments are issued early. SSI recipients received their June payment on Friday, May 30.

How the 2025 COLA Impacts Your Benefits?

In 2025, Social Security recipients saw a 2.5% Cost-of-Living Adjustment (COLA). While not as high as the 8.7% increase in 2023, it’s still a welcome bump in income during times of steady inflation.

Here’s what the average retirement benefits look like after the COLA:

| Category | 2025 Amount (Post-COLA) |

|---|---|

| Retired worker (average) | $1,976 |

| Spouse of retired worker | $893 |

| Disabled worker | $1,537 |

| SSI (individual) | $967 |

| SSI (couple) | $1,450 |

These numbers are based on official projections and rounded up slightly from SSA data.

Supplemental Security Income (SSI): What’s Changing

SSI helps low-income individuals who are blind, disabled, or over age 65. As of 2025:

- Individuals can receive up to $967/month

- Couples can receive up to $1,450/month

Payments are reduced based on countable income. Some states also add their own supplemental payments, so actual amounts may vary depending on where you live.

Social Security Fairness Act of 2025: What It Means

Passed in early 2025, the Social Security Fairness Act eliminated two controversial provisions:

- Windfall Elimination Provision (WEP)

- Government Pension Offset (GPO)

These rules reduced benefits for public-sector workers who also had pensions from jobs not covered by Social Security (like teachers and firefighters). The removal of WEP and GPO means millions of retirees could see increases of several hundred dollars per month.

However, due to implementation challenges, SSA processing delays are affecting everything from Medicare premiums to new benefit approvals. More than 900,000 claims tied to the Fairness Act are still being handled manually.

Real-Life Example: Jim from Montana

Jim, a retired engineer from Montana, waited until age 70 to file for Social Security. He earned at or above the taxable maximum for 35 years. In June 2025, his benefit hits $5,108—the maximum possible.

Meanwhile, his wife Carol, who worked part-time and claimed early at age 62, receives just $1,130. This illustrates the huge difference timing and income make.

Pro Tips for Maximizing Your Social Security

- Delay Benefits: If possible, wait until 70 to file.

- Track Earnings: Ensure SSA has your correct income history by checking your earnings record annually.

- Consider Spousal Strategy: You may be eligible for benefits based on a spouse’s work record.

- Use SSA Calculators: Try tools like the Social Security Quick Calculator to run the numbers.

- Plan for Taxes: Social Security may be taxable. Up to 85% of benefits can be taxed based on your income.

Social Security Sends Out $967–$1,450 Checks; Check Your Deposit Date Now

Big $5,108 Social Security Checks Hitting Accounts This Week — See If You Qualify!

June 2025 Social Security Payment Dates Revealed; See When Your Check Is Coming