$3,089 Retirement Payments Coming in June: If you’re gearing up for retirement or already receiving Social Security, you’ve probably heard the buzz about $3,089 retirement payments coming in June 2025. But what does that really mean—and do you qualify? In this comprehensive guide, we’ll unpack everything you need to know about the average monthly Social Security benefit, how it’s calculated, who qualifies, when payments arrive, and how to make the most of your retirement income. Whether you’re a retiree, a soon-to-be retiree, or just someone planning ahead, this article gives you the full scoop.

$3,089 Retirement Payments Coming in June

The $3,089 average retirement benefit for couples is a significant income stream, and understanding how it works is essential to maximizing your financial well-being. Whether you’re about to retire or years away, making smart decisions today can mean thousands more in your pocket later. Take control of your retirement. Review your earnings, delay if you can, and use every available resource to ensure you’re on the best possible path.

| Topic | Details |

|---|---|

| Average Retirement Benefit (Couples) | $3,089/month in 2025 |

| Individual Average | $1,907/month |

| Maximum Benefit | Up to $5,108/month at age 70 |

| June 2025 Payment Dates | June 11, 18, or 25 |

| Eligibility Requirements | 40 work credits, age 62+, payroll tax contributions |

| Early Claim Penalty | Up to 30% reduction for claiming at 62 |

| Full Retirement Age (FRA) | 66–67 depending on birth year |

| Are Benefits Taxed? | Yes, above income thresholds |

| Medicare Part B Impact | Premium deducted from benefit |

| Official Resource | ssa.gov |

What Is the $3,089 Retirement Payment?

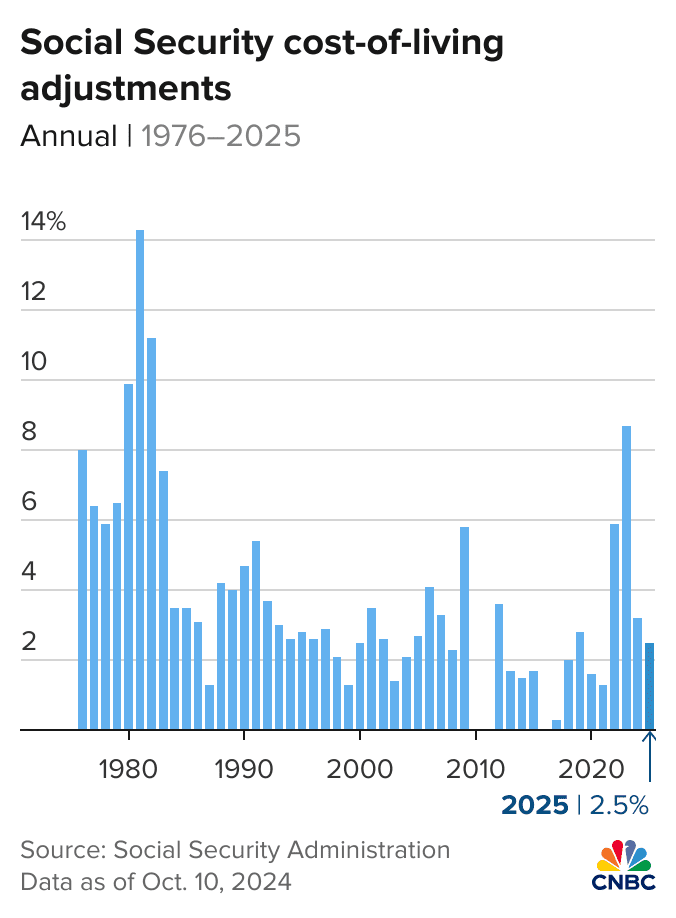

The $3,089 figure refers to the average monthly Social Security benefit for retired couples receiving payments in 2025. This amount reflects a 2.5% cost-of-living adjustment (COLA) announced by the Social Security Administration (SSA) to help keep pace with inflation.

For individual retirees, the average monthly benefit is $1,907—though your actual payment could be more or less depending on your lifetime earnings, work history, and when you choose to start claiming benefits.

It’s Not a Bonus—It’s Your Entitlement

This isn’t a government giveaway—it’s money you earned by working and paying payroll taxes over your lifetime. Social Security is a pay-as-you-go program, meaning today’s workers fund today’s retirees through FICA taxes.

Brief History of Social Security

The Social Security Act was signed into law by President Franklin D. Roosevelt in 1935 during the Great Depression. Originally created to provide retirement income for older Americans, it has since expanded to include disability insurance (SSDI), survivors’ benefits, and Supplemental Security Income (SSI).

Today, nearly 70 million Americans receive benefits each month.

Who Qualifies for the June 2025 Payment?

To be eligible for Social Security retirement payments, you must meet the following conditions:

1. Earned at Least 40 Work Credits

This typically means you’ve worked and paid Social Security taxes for at least 10 years. You earn one credit for every $1,730 in wages in 2025, up to four credits per year.

2. Age 62 or Older

You can start claiming retirement benefits as early as age 62. However, claiming early reduces your monthly payment permanently.

3. Paid Social Security Taxes

If you worked a job that deducted FICA taxes, you’ve contributed to Social Security. Even self-employed individuals qualify if they paid SECA taxes.

4. Spousal and Survivor Benefits

Even if you never worked outside the home, you may qualify for up to 50% of your spouse’s benefit. Divorced and widowed individuals may also qualify under certain conditions.

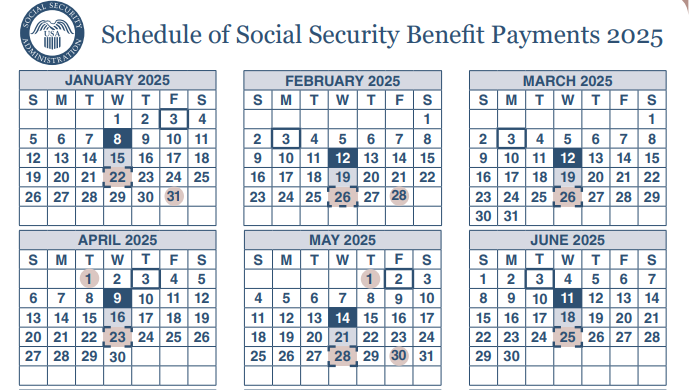

When Will You Get Paid in June 2025?

Social Security payments are sent based on your birth date:

- Born 1st–10th: Paid on Wednesday, June 11

- Born 11th–20th: Paid on Wednesday, June 18

- Born 21st–31st: Paid on Wednesday, June 25

- If you started receiving benefits before May 1997: June 3

- SSI recipients (Supplemental Security Income): June 1

How to Maximize $3,089 Retirement Payments Coming in June?

Want to shoot for the maximum possible benefit—$5,108/month in 2025? Here’s what it takes:

Work at Least 35 Years

Social Security calculates your benefit using the highest 35 years of indexed earnings. If you worked fewer than 35 years, the SSA adds zeros for the missing years, which lowers your average.

Earn at or Above the Wage Cap

Only earnings up to a certain amount each year are counted. In 2025, the wage cap is $168,600. Earnings above this threshold aren’t taxed for Social Security and don’t increase your benefit.

Delay Benefits Until Age 70

While you can claim at 62, each year you wait increases your payment by about 8% per year until age 70. Waiting until 70 could earn you up to $5,108/month in 2025.

Understanding COLA and Its Impact

Every year, Social Security adjusts benefits based on the Consumer Price Index (CPI-W). This increase is called the Cost-of-Living Adjustment (COLA). In 2025, the COLA is 2.5%, boosting the average couple’s benefit from about $3,014 in 2024 to $3,089 in 2025.

COLAs ensure that your buying power doesn’t shrink due to inflation.

Taxes on Social Security Benefits

Yes, Social Security benefits can be taxed, depending on your combined income (which includes half of your benefits, wages, and other income).

- Single filers: Income over $25,000 → taxable

- Married filing jointly: Income over $32,000 → taxable

Up to 85% of your Social Security benefit could be subject to federal income taxes. Some states also tax benefits—check with your state tax agency.

How Medicare Impacts Your Payment?

Most retirees are automatically enrolled in Medicare Part A at age 65. But Part B premiums, which are around $174.70/month in 2025, are typically deducted directly from your Social Security check.

This means the actual amount deposited in your bank account could be lower than your gross benefit amount.

Common Mistakes to Avoid

Claiming Too Early

Many retirees claim benefits at 62 out of fear or misinformation. This decision can reduce your benefit by up to 30% compared to waiting until full retirement age.

Not Reviewing Your Earnings Record

Your Social Security benefit is based on your reported earnings. If your record has errors or missing data, your payment may be lower than it should be.

Assuming SSA Will Advise You

The Social Security Administration doesn’t provide personalized advice on when to claim. The decision is yours—and a wrong choice could cost you tens of thousands over a lifetime.

2026 Retirement Payment Could Rise — Check How Much Your Check May Increase!

Goodbye to Retirement at 65: Social Security Raises the Bar—Starting in 2026

Terrified of Going Broke in Retirement? These 9 Expert Tips Can Save Your Future

Frequently Asked Questions (FAQs)

Can I collect benefits based on my ex-spouse’s work record?

Yes. If your marriage lasted at least 10 years and you’re unmarried and 62 or older, you may qualify for up to 50% of your ex-spouse’s benefit.

Can I work while receiving Social Security?

Yes, but if you’re under full retirement age and earn more than $22,320 (in 2025), your benefit may be temporarily reduced. Once you reach FRA, those withheld benefits are repaid over time.

Are Social Security benefits adjusted for inflation?

Yes. COLAs are applied annually based on inflation metrics. The 2025 COLA is 2.5%.

Is Social Security going bankrupt?

No, but without reforms, the trust fund could be depleted by 2034. Payroll taxes will still cover about 78% of scheduled benefits.

Can I receive Social Security and a pension?

Yes, but if your pension is from non-covered employment (like certain government jobs), the Windfall Elimination Provision (WEP) or Government Pension Offset (GPO) might reduce your benefit.