$1700 CPP Payments In July 2025: The Canada Pension Plan (CPP) plays a crucial role in ensuring the financial well-being of Canadians after they retire. If you’re waiting for your CPP payments in July 2025, you’re probably wondering about the exact payment date, eligibility requirements, and how much you can expect to receive. Don’t worry; we’ve got you covered. Whether you’re a retiree or someone planning for their future, this article breaks down everything you need to know about CPP payments, eligibility, and the impact of different factors on the amount you could receive.

$1700 CPP Payments In July 2025

Understanding your CPP payments and eligibility is crucial to securing your financial future. Whether you’re preparing for retirement or currently receiving payments, staying informed will help you make the best decisions for your situation. By knowing when payments are due, understanding how much you’ll receive, and ensuring you’re on track with your contributions, you can manage your finances with confidence. Remember: Your CPP benefits are a valuable resource, but they should be part of a larger financial plan that includes savings, investments, and other income sources. Stay informed, stay prepared, and don’t hesitate to reach out for any questions.

| Key Information | Details |

|---|---|

| July 2025 Payment Date | Tuesday, July 29, 2025 |

| Eligibility Requirements | 60+ years old, valid contributions to CPP |

| Maximum CPP Amount | Up to $1,433/month (age 65) and more if delayed until 70 |

| Direct Deposit Benefits | Avoids postal delays and ensures timely payments |

| Official Website | Canada Pension Plan Official Site |

| FAQs Section | Yes – common questions answered below! |

Introduction to Canada Pension Plan (CPP)

The Canada Pension Plan (CPP) is a vital social insurance program for Canadian workers and their families. It provides retirement, disability, and survivor benefits based on the contributions workers make during their careers. As Canadians age and approach retirement, the CPP becomes a key part of their financial security.

While the CPP is designed to support retirees and others who’ve contributed to the system, understanding the details of payment schedules, eligibility, and how much you’re entitled to can be overwhelming. The most pressing question for many is, “How much will I get, and when?” In this article, we’ll dive into all the details, focusing on the $1700 CPP payments expected in July 2025.

What You Need to Know About CPP Payments in July 2025?

As part of the CPP payment schedule for 2025, the payment date for July is set for Tuesday, July 29, 2025. Mark your calendar because if you’re expecting a direct deposit or a paper check, you’ll want to know exactly when the funds will be available to you.

The payment schedule follows the same pattern each year, with monthly payments typically arriving at the end of each month. For those who are signed up for direct deposit, the payment will be available in your account on this date. If you receive your payments by mail, however, you should expect some variability due to postal service timelines.

Key Factors that Affect Your CPP Payment Amount

Your CPP payment depends on several factors, such as:

- The amount you contributed during your working years

- The age at which you start receiving benefits

- Any gaps in contributions or periods of low income

- Spousal Benefits and Divorced Spouses

Let’s break these down in more detail.

1. Your Contributions

Your CPP payment is based on how much you contributed during your working years. For every year you earned income and paid into the CPP system (via payroll deductions or self-employed contributions), you earned “contributory credits”. The more years you contributed and the higher your income, the higher your monthly payment will be.

If you were employed or self-employed for a substantial number of years, your contributions would have built up a larger CPP benefit. However, it’s important to note that the system is designed to replace only a portion of your pre-retirement income. So, if you were a high-income earner, you may not receive a benefit equal to your previous earnings.

2. Age at Which You Start Receiving CPP

The age at which you start receiving CPP significantly impacts the amount you’ll receive. Let’s break it down:

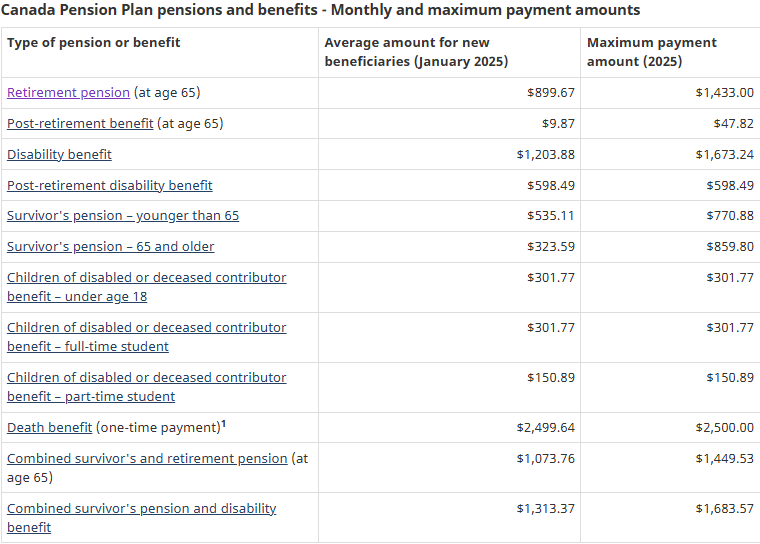

- Starting CPP at age 65: This is the standard age for receiving the full CPP benefit. For 2025, the maximum monthly amount for someone starting at age 65 is approximately $1,433 (though most recipients will get less, depending on their contributions).

- Starting CPP early at age 60: If you choose to start receiving CPP earlier, at age 60, you’ll receive a reduced monthly amount. The reduction is 0.6% for every month before age 65, meaning you could get up to 36% less if you start at 60. Starting earlier may be beneficial if you need the income right away, but the trade-off is the reduction in the monthly amount.

- Delaying CPP until age 70: On the flip side, if you wait to start receiving CPP until age 70, you will earn an increase of 0.7% for each month you delay. This can add up to a 42% higher payment compared to starting at age 65. That means you could receive up to $2,034 per month if you wait until age 70. Delaying can be a great option for those who are in good health and have other income streams to support them in the meantime.

3. Low or No Income Periods

What happens if you have gaps in your earnings, due to disability or other reasons? Fortunately, the CPP has provisions for those situations. If you had periods where you earned less than the basic minimum threshold ($3,500 per year), the system may still consider you for higher payments. For example, child-rearing credits can boost your CPP if you were raising children under 7 years of age.

Moreover, if you had a period of low earnings due to a disability or part-time work, the CPP system can adjust your contributions, so those low-earning years don’t negatively impact your final benefit. The system ensures that you won’t be unfairly penalized for circumstances beyond your control.

4. Spousal Benefits and Divorced Spouses

Many people may not realize that spousal benefits are part of the CPP. If you are married, your spouse can receive a spousal benefit based on your contributions to CPP, provided you’ve both contributed to the system. This is especially helpful for spouses who may not have worked as much or at all during their marriage.

If you’ve been divorced, your ex-spouse may also be entitled to a portion of your CPP benefits, depending on the length of the marriage and your contributions. This is known as credit splitting. After a divorce, the contributions you made during the marriage are divided between you and your ex-spouse. This ensures that both parties receive a fair share of the CPP benefit they helped accumulate during the marriage.

Step-by-Step Guide to $1700 CPP Payments In July 2025 Eligibility

So, how do you know if you qualify for CPP? Let’s break it down step-by-step.

Step 1: Confirm Your Age

To be eligible for CPP retirement benefits, you need to be at least 60 years old. However, you will receive a reduced amount if you start collecting benefits before the standard age of 65. If you decide to take CPP early, you will experience a permanent reduction to your monthly payment. Starting at 60 reduces the amount by 0.6% per month, or 7.2% per year.

Step 2: Check Your Contribution History

Did you contribute enough to the CPP system? This is key to determining your eligibility and how much you’ll receive. The Canada Pension Plan is a pay-as-you-go system, meaning that when you work, you pay into the system, and when you retire, you draw from it. The amount you contributed during your working years directly affects your benefit.

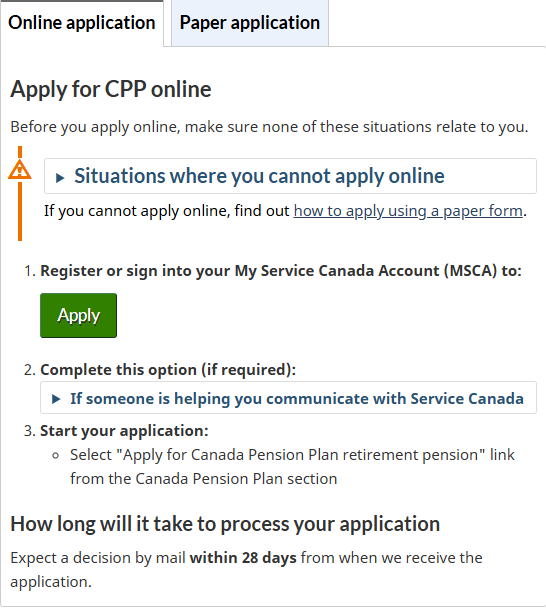

You can review your CPP contributions by accessing your Statement of Contributions, available through Service Canada. It will outline your total contributions and give you an idea of what to expect when you apply for benefits.

Step 3: Confirm Your Work History

Did you work and pay into the CPP for a minimum of several years? If you had a gap in your career or were self-employed for a period, it may affect your total entitlement. If you didn’t contribute much, you might not receive the full benefits.

For example, if you only contributed to CPP for 10 years out of a possible 40 years, your monthly payment will be significantly lower than someone who contributed for 40 years. However, there are provisions like child-rearing credits and disability benefits that can help ensure those years don’t penalize you.

Step 4: Plan Your Retirement

If you’re approaching retirement age, it’s essential to plan ahead. By understanding how CPP payments work and when you can start receiving them, you can better budget for your future. Additionally, you may want to consider other retirement savings options such as RRSPs or Tax-Free Savings Accounts (TFSAs). Diversifying your income sources is key to maintaining financial stability during retirement.

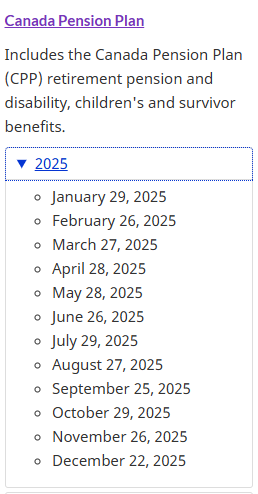

CPP Payment Date for 2025

The following is the official CPP payment schedule for the remainder of 2025, including July:

| Month | Payment Date |

|---|---|

| January | January 29, 2025 |

| February | February 27, 2025 |

| March | March 28, 2025 |

| April | April 29, 2025 |

| May | May 28, 2025 |

| June | June 27, 2025 |

| July | July 29, 2025 |

| August | August 27, 2025 |

| September | September 25, 2025 |

| October | October 29, 2025 |

| November | November 26, 2025 |

| December | December 22, 2025 |

Direct Deposit and Other Benefits

To make sure you don’t miss your payment, consider signing up for direct deposit. This ensures that your CPP payments arrive directly in your bank account on time, without waiting for mail delivery. For more details on how to register for direct deposit, visit the official Service Canada website.

How CPP Interacts with Other Benefits?

It’s essential to understand how your CPP payments may be affected by other government benefits or pensions you receive.

Old Age Security (OAS) vs. CPP

While CPP focuses on the contributions you made during your working years, the Old Age Security (OAS) program is based on your residency in Canada. OAS payments start at age 65, but they are not dependent on your work history. Some Canadians may qualify for both OAS and CPP.

For example, if you’ve worked a few years in Canada and have earned low CPP payments, you may still be eligible for OAS, which can provide an additional financial boost.

Canada Pension Plan Disability (CPP-D)

If you’re unable to work due to a disability, you may qualify for CPP Disability benefits (CPP-D). This provides a monthly payment to individuals who meet specific medical and work criteria. To apply for CPP-D, you must show evidence of the disability’s severity and duration. It’s a vital benefit for those who cannot work and need financial support.

Canada Child Benefit 2025: Exact Payment Dates From June to September Revealed!

2025 Canada Pension Plan Changes Are Here — What Every Retiree and Worker Must Know Now

Canada’s $2200 Payment Hits This Month—Are You Eligible for the Cash?