$1,000 Trump Account Rules Revealed: You might’ve heard the buzz: The U.S. House has passed a new tax proposal that includes something brand new — Trump Accounts. These government-funded savings accounts are designed to give every eligible newborn a $1,000 head start. And if you’re wondering what the catch is, where the money can go, and how it affects your family — we’ve got the full scoop. Let’s dive into the details and uncover everything you need to know about this potentially game-changing program.

$1,000 Trump Account Rules Revealed

Trump Accounts could give every child a stronger start in life — with money set aside from birth to help pay for college, buy a home, or start a business. That small $1,000 boost has the potential to grow into something meaningful over time. If used wisely, these accounts could help reduce the wealth gap and teach kids how to manage money early. But to truly make a difference, the program must support families of all income levels — not just those who can afford to contribute more. At its best, the Trump Account is about giving every child a fair shot at success, no matter where they come from.

| Feature | Details |

|---|---|

| Program Name | Trump Accounts (aka MAGA Accounts) |

| Initial Deposit | $1,000 per eligible newborn |

| Eligibility Period | Jan 1, 2025 – Jan 1, 2029 |

| Additional Contributions | Up to $5,000/year |

| Approved Uses | Education, First Home, Entrepreneurship |

| Restricted Uses | Consumer goods, vacations, debt repayment |

| Tax Rules | Tax-deferred growth; long-term capital gains on approved use |

| Withdrawal Rules | 50% at 18, full at 25–30, unrestricted after 30 |

| More Info | Congress.gov |

What Are Trump Accounts?

Trump Accounts — formally titled Money Accounts for Growth and Advancement (MAGA) — are part of a federal push to promote wealth-building activities among future generations. If passed by the Senate and signed into law, every child born in a 4-year window (2025–2029) will automatically receive a $1,000 tax-deferred investment account. These funds are intended to grow over time through market investments, and can later be withdrawn for specific purposes like school, a down payment on a home, or starting a business.

Why Now? The Economic Context

The U.S. faces growing inequality, stagnant wages, and rising costs for education and housing. At the same time, traditional wealth-building avenues are becoming out of reach for many young Americans.

The Trump Account proposal mirrors global ideas like the UK’s “Child Trust Fund” or “baby bonds” promoted by economists like Darrick Hamilton. The idea: give every child a small nest egg early on — and let it grow.

“We need tools that empower all Americans to participate in economic growth — not just the wealthy few.” – Brookings Institution

Who’s Eligible?

To receive the $1,000 government deposit:

- Children must be born between Jan 1, 2025 and Jan 1, 2029

- Must be a U.S. citizen or lawful permanent resident

- Must have a Trump Account registered through an approved provider

How $1,000 Trump Account Works?

Step-by-Step:

- Account Opens at Birth

- Government deposits $1,000 automatically.

- Parents Manage the Account

- Until the child turns 18, a parent or legal guardian acts as the account custodian.

- Annual Contributions Allowed

- Up to $5,000/year can be added by family, friends, employers, or nonprofits.

- Tax Benefits

- No tax on gains while funds remain invested.

- Controlled Withdrawals

- Partial use at 18, full at 25–30, unrestricted after 30.

Where You Can Use the Funds

Only certain uses are considered “qualified” — meaning no tax or penalties apply:

Education

- College tuition

- Vocational schools

- Textbooks, laptops, lab fees

First-Time Home Purchase

- Down payment

- Closing costs

- Property-related expenses

Starting a Business

- Equipment, permits, marketing

- Initial capital and legal setup

Where You Can’t Use the Funds (Without Penalties)

Unauthorized uses = regular income tax + 10% penalty.

- Personal travel or vacations

- Clothes, electronics, or cars (unless for a business)

- Gambling, cryptocurrency speculation

- Paying off credit cards or loans

Real-World Examples

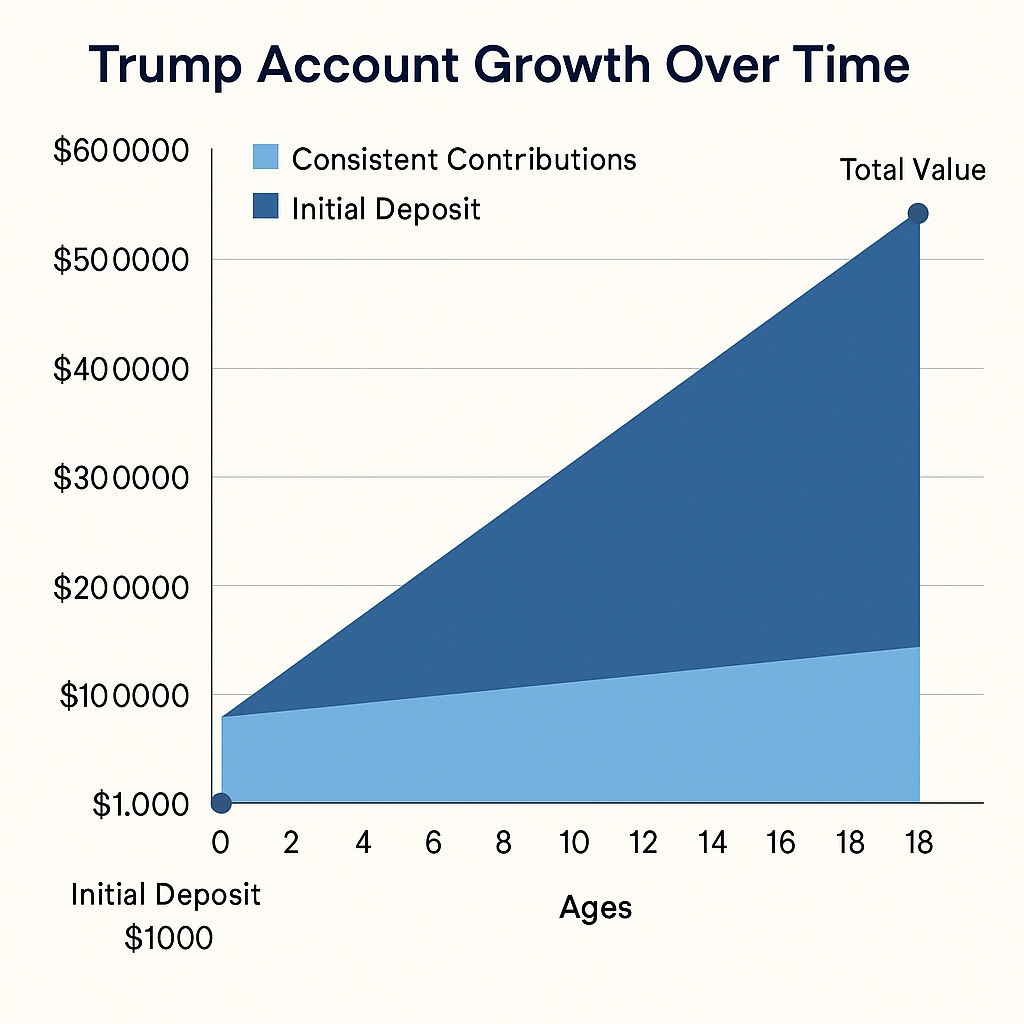

Middle-Income Family

Invests $3,000/year until age 18. Result: ~$100,000 at 6% growth.

Use: Tuition + down payment on a starter home at 25.

Grandparents on a Budget

Contribute $500/year. Account reaches ~$20,000.

Use: Tech school and business launch (e.g., mobile pet grooming).

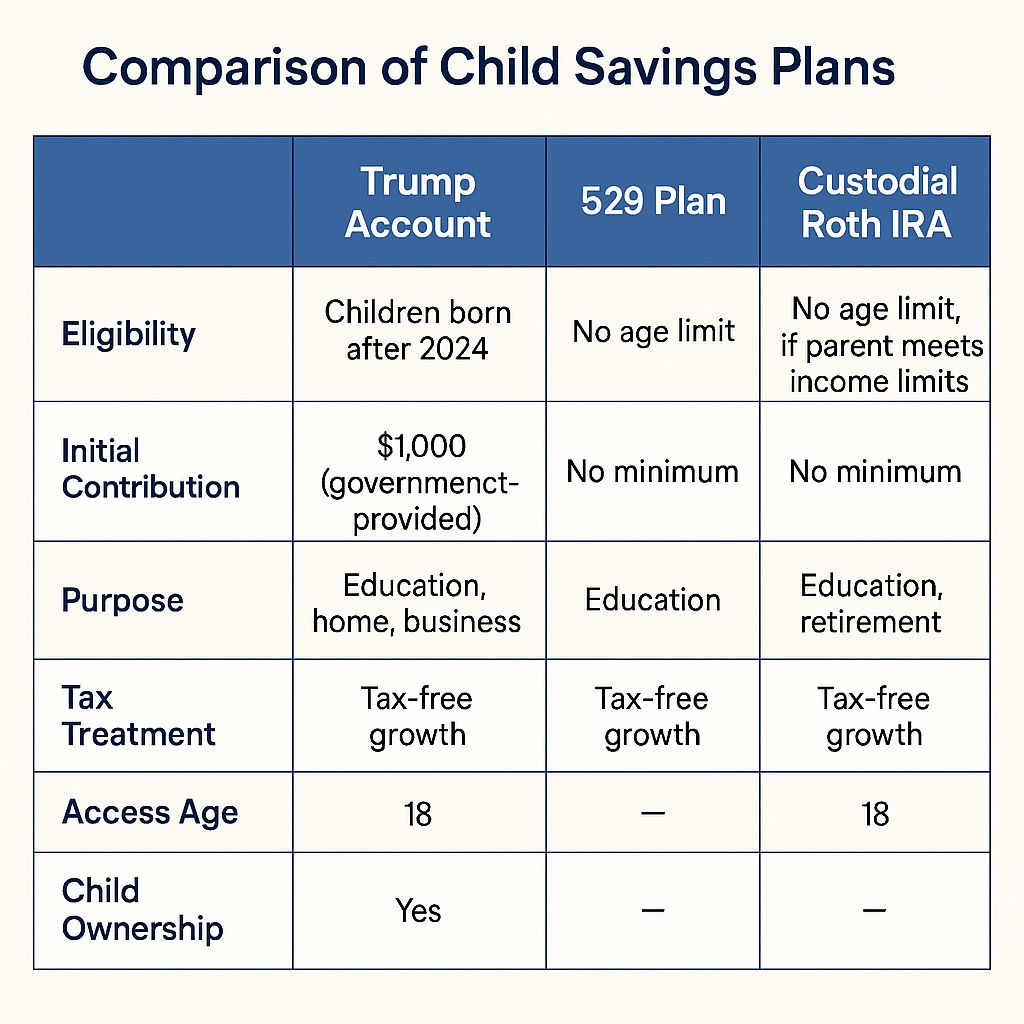

Trump Accounts vs. Other Child Savings Tools

| Account Type | Trump Account | 529 Plan | Custodial Roth IRA |

|---|---|---|---|

| Seeded by Gov’t? | Yes | No | No |

| Tax-Deferred Growth? | Yes | Yes | Yes |

| Use Restrictions? | Broader | Education only | Retirement use only |

| Annual Contribution Limit | $5,000 | Up to $17K (varies) | $7,000 (earned income only) |

| Penalty for Misuse? | Yes | Yes | Yes |

Investment Options Inside Trump Accounts

Once open, Trump Accounts can be invested in:

- Index Funds (e.g., S&P 500)

- ETFs

- Target-Date Funds

- Bonds or Balanced Mutual Funds

Pro tip: Use low-fee ETFs for long-term growth, like VTI (Total Stock Market ETF).

Avoid risky investments like meme stocks, individual small-cap stocks, or crypto — especially for minors.

Contribution Rules

- Annual limit: $5,000 from any source (parent, grandparent, family friend).

- No income restrictions for contributors.

- Matching contributions may be considered in future policy (not currently law).

Tax & Legal Considerations

- Tax-Free Growth: Earnings are not taxed while in the account.

- Withdrawals: Taxed at long-term capital gains rate if used correctly.

- Penalty: 10% + regular tax for unqualified uses.

- Account Ownership: Controlled by parent until 18.

Always consult a CPA or financial advisor before claiming withdrawals on taxes.Absolutely! Here’s an elaborated and human-centered version of the section titled “How to Open a Trump Account (When It Launches)” — written in a friendly, helpful tone that makes it clear and relatable for all types of readers, from first-time parents to financial planners:

How to Open a Trump Account (When It Launches)?

Opening a Trump Account won’t be like filing your taxes or reading the fine print on a mortgage — at least, it shouldn’t be. The idea is to make it simple, secure, and accessible to every new parent, no matter their background or financial experience.

While the full rollout details are still in the works, here’s what the process will likely look like based on how similar programs are run — and what you can expect:

Step 1: Confirm Your Child’s Eligibility

The first box to check is your child’s birthdate. To qualify for the automatic $1,000 deposit, your baby must be born between January 1, 2025, and January 1, 2029. They’ll also need to be a U.S. citizen or lawful permanent resident.

You’ll likely need basic documents like:

- A birth certificate

- Your child’s Social Security Number

- Proof of residency if required by the financial provider

Step 2: Choose a Trusted Financial Institution

Next, you’ll open the Trump Account through an approved financial partner — most likely big names like Fidelity, Vanguard, Schwab, or a federally backed bank or credit union.

You won’t need to be a finance expert to do this. Many institutions will likely offer easy online portals where you can register your child’s account with just a few clicks. Some may even guide you through it on the phone or in person.

“If you can open a savings account online, you can open a Trump Account.” — that’s the goal.

Step 3: Register as the Custodian

As the parent or legal guardian, you’ll act as the custodian of your child’s Trump Account. This means:

- You control the account until they turn 18

- You decide how the money is invested

- You’re responsible for ensuring the funds are used appropriately

Don’t worry — it’s not as intimidating as it sounds. Most providers will offer default investment options if you’re not sure where to start (like target-date or balanced funds).

Step 4: Start Contributing (If You Can)

While the government provides the initial $1,000, you — and anyone else — can contribute up to $5,000 per year.

Even small, regular contributions — $10 or $20 a month — can add up in a big way over 18 years. Grandparents, godparents, and family friends can pitch in too.

Think of it like a modern baby shower gift — one that pays off in the long run.

Step 5: Invest for Long-Term Growth

Once the account is open, it’s time to let the money work for your child’s future. That means choosing smart, low-cost investment options like:

- Index funds (e.g., S&P 500 or total market)

- Target-date retirement funds (automatically adjust risk)

- Balanced funds with a mix of stocks and bonds

Most platforms will offer auto-investing tools or robo-advisors if you’re unsure where to begin. And remember — the longer the money stays invested, the more it can grow thanks to compound interest.

Step 6: Monitor and Adjust Over Time

Check in on the account once or twice a year — not every week. You’ll want to:

- Adjust risk as your child gets older

- Make sure contributions are still on track

- Keep documents up to date

When your child turns 18, you’ll help guide them through their first withdrawal — whether it’s for college, trade school, or their first business venture.

What Critics Are Saying?

While many praise the idea, not everyone’s sold. Critics argue:

- Wealthier families will contribute more and benefit more.

- No emergency access options.

- No provisions for disabled children or undocumented families.

Groups like the Urban Institute and Economic Policy Institute recommend changes to make the program more equitable, such as income-based matches or tiered contribution incentives.